23rd November,2018 Daily Global Regional Local Rice E-Newsletter

https://www.slideshare.net/MUJAHIDALI81/23rd-november-2018-daily-global-regional-local-rice-e-newlsetterGlobal Rice Starch Market Research Report by New Developments, Revenue, New Applicants, Industry Concentration Rate 2023

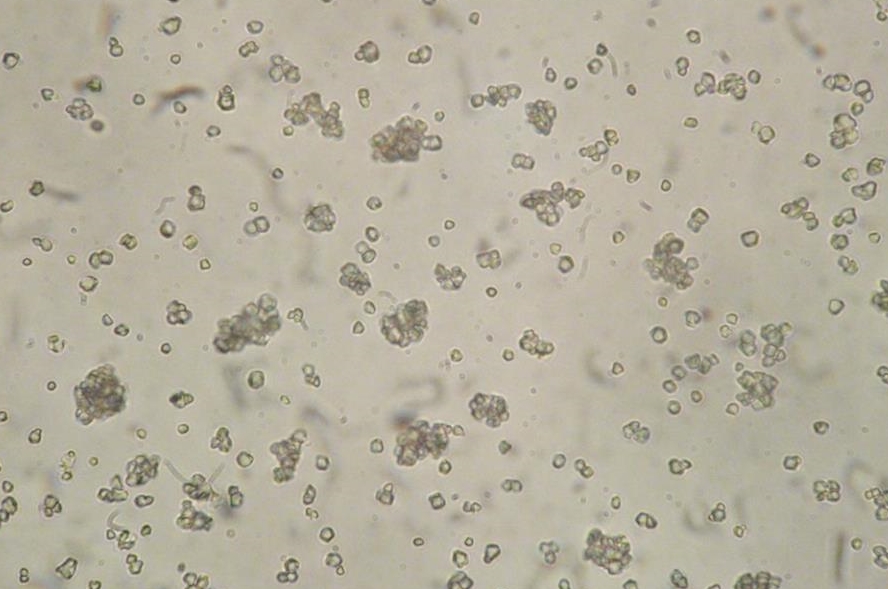

Global Rice Starch Market 2018-2023, has been prepared based on an in-depth market analysis with inputs from industry experts. The report covers the market landscape and its development prospects over the coming years. The report also contains a discussion of the key vendors operating in this market.

The Rice Starch Market report includes Rice Starch Market Revenue, Investment Opportunity, Market Features, Market Demand by Segment & Rice Starch Growth aspects. A wide range of applications, Utilization ratio, Supply and demand analysis are also consist in the report. It shows manufacturing capacity, Rice Starch Price during the Forecast period from 2018 to 2023.

The report covers the current scenario and the growth prospects of the global Rice Starch market for 2018-2023. To calculate the market size, the report presents a detailed picture of the market by way of study, synthesis, and summation of data from multiple sources.

Ask Sample PDF of Rice Starch Market Report: https://www.precisionreports.co/enquiry/request-sample/12701777

Rice Starch Market Segment by Manufacturers includes: BENEO, Ingredion, Bangkok starch, Thai Flour, AGRANA, WFM Wholesome Foods, Golden Agriculture, Anhui Lianhe, Anhui Le Huan Tian Biotechnology, and many more.

Market segment by Regions/Countries, this report covers

By Types, the Rice Starch Market can be Split into: ,Native regular rice starch, Native waxy rice starch, Industry Grade

By Applications, the Rice Starch Market can be Split into: ,Food Industry, Pharmaceutical Industry, Cosmetic Industry, Others

Browse Detailed TOC, Tables, Figures, Charts and Companies Mentioned in Rice Starch Market Research Report: https://www.precisionreports.co/12701777

Major Points Covered in this Report are: Industry Overview of Rice Starch, Manufacturing Cost Structure Analysis of Rice Starch Market, Sales & Revenue Analysis of Rice Starch Market, Production Analysis of Rice Starch by Regions, Market Dynamics Considering Opportunities, Constraint and Driving Force, Feasibility Analysis of New Project Investments

Some Major Point cover in this Rice Starch Market report are: –

Get Full Report at $ 3480 (Single User License) at:

Indian rice samples fail test for Egypt’s rice import tender

THU, NOV 22, 2018 - 11:00 PM

[DUBAI] The Indian rice samples offered in Egypt's first rice purchasing tender for 2018 have all failed a cooking test required for approval for purchase, three trade sources with direct knowledge said on Thursday.

All Chinese rice samples were accepted while one Vietnamese rice sample was accepted and the other rejected, they said.

Egypt, which has turned from a rice exporter to an importer because of water shortages, has in the past purchased rice from India.

The samples are being tested by a research centre at before approval of offers.https://www.businesstimes.com.sg/energy-commodities/indian-rice-samples-fail-test-for-egypt%E2%80%99s-rice-import-tender

Food for Thought: Grain output – don’t bite more than you can chew

Thursday, Nov 22

Government is chasing higher production in wheat and rice by fixing bigger and bigger output targets. It is time to evaluate whether we need so much. GRAIN OUTPUT – DON’T BITE MORE THAN YOU CAN CHEW ————————————————- By Stuti Chawla Over the last seven decades, India has gathered enough experience in handling food shortages. It is the art of managing surpluses that we are yet to master. To be fair, surpluses in food grain output are fairly recent, and the focus of governments so far has rightly been on meeting domestic demand. But with crop output now exceeding consumption, and the surpluses becoming systemic rather than occasional, there needs to be some serious thought on handling them, particularly in the case of food grains. India’s rice and wheat crops were at record highs last year at 112.9 mln tn and 99.7 mln tn, respectively. The government has set production targets for this year even higher at 113.0 mln tn for rice and 100.0 mln tn for wheat. But do we really need so much food grain? Piling grain reserves in the central pool certainly indicate otherwise. At the start of October, the government had 54.26 mln tn food grain in stock, more than double the required level. The government will add more to its grain reserves this year due to larger crops and higher minimum support prices. It won’t be easy to manage these excesses. The last time India had such a large grain surplus was in the early 2000s. In fact, at one point of time, there was so much grain rotting in the central pool that a parliamentary committee had recommended dumping it into the sea to make space for more. The Atal Bihari Vajpayee government at that time gave subsidies to export food grains from the central pool. But the problem was that the government didn’t know when to stop. It released so much grain for exports that India had to turn to imports a few years later to re-build reserves. Even now, exports don’t offer a way out unless the government subsidises them, and throwing food grains in the sea is definitely not a solution. India exports close to 13 mln tn rice, which is about a fourth of the global rice trade. Increasing that share in the world rice trade is getting tougher with each increase in the minimum support price. In the case of wheat too, exports have been unviable for the last few years, as the MSP hikes have made Indian wheat costlier. One way of limiting these surpluses is to diversify to other crops. According to estimates drawn up jointly by Indian Council of Agricultural Research and International Food Policy Research Institute in 2016, India will need 111.8 mln tn rice and 98.3 mln tn wheat by 2020. These targets were surpassed last year. The study has projected India’s demand for rice at 122.4 mln tn by 2030, and wheat at 114.6 mln. To meet this demand, India’s food grain production will need to grow at a much slower pace than it has in the past decade. Over the last few years, India seems to have become more resilient to weather vagaries and crop yields are definitely improving. To then temper the growth rate, there should be a well chalked out plan for encouraging farmers to switch to other crops. The last plan rolled out by the government on farm policy was the National Food Security Mission in 2007, which listed out targets for increasing production of wheat, rice and pulses in five years, and detailed the steps the government would take to meet them. Implementation of the plan was closely monitored, and most of the production targets were met well before time. A new plan is the need of the hour, with a longer term view and a focus on consumption patterns by 2030. As countries develop, there is a marked decrease in consumption of basic cereals such as wheat and a corresponding increase in demand for protein-rich pulses, meat, edible oils, and also fruits and vegetables. This holds true for India as well. Currently, India is comfortable in most of these, with the exception of edible oils, but that may not be the case a decade hence. The ICAR–IFPRI study has predicted that demand for fruits, vegetables and meat will outpace production by 2030. These are the sectors the government should now be focusing on. Government policies, including subsidies, support prices and infrastructure support, should be tailored to increase production of horticulture crops, coarse cereals and oilseeds and availability of poultry and meat products. Crop diversification was the buzz word in India at start of this millennium. It died a quiet death within a few years, as production of wheat and rice had fallen to unsustainable levels by 2004-05. The problem with the diversification plan was that it was not thought through, and lacked a clear mandate on requirement. The government should learn from past mistakes and draw up a new crop production policy that is well-balanced, practical and in tune with the times, instead of setting arbitrary targets for food grain production. (Food for Thought is a monthly column by Stuti Chawla, our Assistant Editor-Commodity. Stuti is passionate about crime thrillers and food, and her insights on farm policies are equally piquant) Cogencis Tel +91 (11) 4220-1000 Send comments to feedback@cogencis.com http://www.cogencis.com/newssection/food-for-thought-grain-output-dont-bite-more-than-you-can-chew/ 20,000 drought-hit tribal farmers march to Mumbai

This is the third mass farmer protest the state has witnessed this year

|

The

The

No comments:

Post a Comment