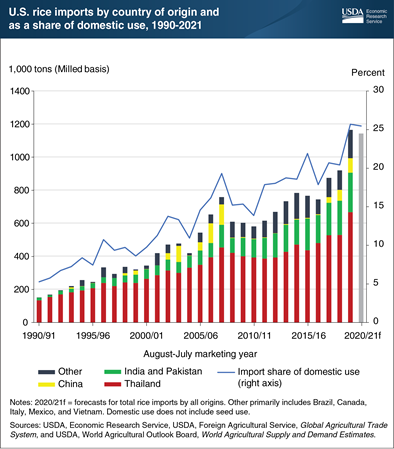

Sharp increase in imports from Asia boosted U.S. 2019/20 rice imports to record high, with little decline projected for 2020/21

U.S. rice imports hit record highs in the second quarter of calendar year 2020, driving up total U.S. rice imports to a record high in marketing year 2019/20 and up 29 percent from the previous year. Imports now account for more than one-quarter of all rice that is used domestically. Growing consumer demand for Asian aromatic varieties of rice drive this development. Although the United States itself produces several aromatic varieties of rice, the consumer qualities are not the same as those for the Asian varieties. The bulk of the increase in U.S. rice imports in 2019/20 came from Thailand, up almost 29 percent from a year earlier. In recent years, 80-85 percent of Thailand’s shipments to the United States has been its jasmine rice, a premium aromatic variety. Combined U.S. imports from India and Pakistan increased 24 percent in 2019/20 to a record 262,000 tons, with most of this rice being basmati rice, also a premium aromatic. Imports of non-aromatic rice have increased as well. China has recently been shipping 66,000-86,000 tons of rice annually, with the U.S. territory of Puerto Rico buying almost all this amount; this market was previously supplied with U.S. rice. The Government of China has been selling its stocks of older rice at substantially discounted prices. Finally, Brazil’s shipments have increased considerably since 2017/18, shipping both regular long-grain milled rice for food use and broken kernel rice for use in processed products. Rice imports in 2020/21 are expected to continue at a strong clip, falling only slightly from the 2019/20 record high with the United States remaining the largest importer in the Western Hemisphere. This chart is drawn from Economic Research Service’s Rice Outlook, September 2020.

Download higher resolution chart (2084 pixels by 2378, 300 dpi)

No comments:

Post a Comment